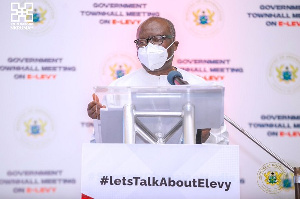

Ken Ofori-Atta, Finance Minister

Ken Ofori-Atta, Finance Minister

Finance Minister, Ken Ofori-Atta has said that the proposed E-Levy government plans to introduce will widen the tax base of the economy, as it will offer the opportunity for all citizens to contribute to revenue generation efforts for national development.

Speaking at the 24th meeting of the Ministerial Committee of the Inter-Governmental Action Group against Money Laundering in West Africa (GIABA), the finance minister said the levy offers a comprehensive system to get all potential taxpayers to contribute their quota to national development adding that the rate of 1.75 percent and exemption of the first GH¢100 transfer per day means that the tax is pro-poor and a major means of raising adequate revenue to execute government’s growth agenda and job creation for young people.

Ofori-Atta further said he is hopeful Ghanaians will understand the good intentions of the government when the ongoing stakeholder and town hall meetings come to completion.

“Ghanaians are largely in favor of paying the E-Levy, contrary to the impression being created from Parliament, but we have to explain to them the levy’s merits and the positive consequences it will bring,” he said.

He was confident that the levy, which was originally billed to start on February 1 to raise some GH¢7 billion, will soon secure parliamentary approval for effective implementation.

The minister cited the upsurge and growth in the value of mobile money transactions from GH¢78 billion in 2016 to almost GH¢950 billion in 2021 as the basis of targeted users of the platform.

“Mobile money has clearly become a tax handle for the future, and must be utilized in the development of Ghana,” he said.

According to data from the Ghana Revenue Authority, only 2.4 million people pay direct taxes compared to more than 20 million who could have been paying. This, the GRA has maintained, needs to be addressed in order to widen the tax net for revenue growth and national development.

About the levy

According to the minister, the E-Levy will affect mobile money transfers between accounts on the same electronic money issuer (EMI); mobile money transfers from an account on one EMI to a recipient on another EMI, transfers from bank accounts to mobile money accounts, transfers from mobile money accounts to bank accounts; and bank transfers on a digital platform or application which originate from a bank account belonging to an individual to another individual.

What it will not cover

Mr. Ofori-Atta added that certain transactions will be exempt from the E-Levy. This, he said, includes cumulative transfers of GH¢100 per day made by the same person; transfers between accounts owned by the same person; transfers for the payment of taxes, fees and charges on the Ghana.gov platform; and electronic clearing of cheques.

It also includes specified merchant payments (i.e. payments to commercial establishments registered with GRA for Income Tax and VAT purposes); and transfers between principal, master-agent and agent’s accounts.

- Unfair E-Levy tax will be scrapped if I'm made president – Mahama assures

- Transfers between bank accounts linked to MoMo wallet should not attract E-Levy – GRA insists

- Ghanaians deserve an account on E-Levy after 18 months – Bright Simons

- Dr. Bawumia was stiffly opposed to E-Levy, IMF loan – Kate Gyamfua alleges

- 1 million MoMo accounts were inactive after E-Levy implementation – ISSER

- Read all related articles