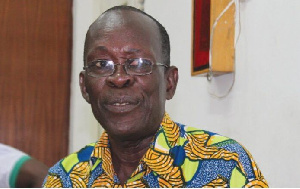

Abraham Koomson, General Secretary of the Ghana Federation of Labour

Abraham Koomson, General Secretary of the Ghana Federation of Labour

The Ghana Federation of Labour has stated that the association has not yet received an official proposal from the government regarding a potential reduction in their pension funds, commonly referred to as a ‘haircut’ by the government.

After a period of over five months during which pension funds were exempted, the government is likely to reverse its decision on a debt restruction program.

Reports state that the Akufo-Addo government has decided to include pension funds in the treatment of domestic debt. It is reported that the government aims to restructure approximately $2.7 billion owed to pension funds in upcoming negotiations.

But Abraham Koomson, the General Secretary of the Ghana Federation of Labour told Joy News that his outfit has not been alerted in that regard.

“We have a committee which is responsible for such meetings so as of now we have not been formally or officially invited to any such meeting,” he said.

However, Koomson disclosed that the association is expecting the government to approach them with a proposal for a ‘haircut’ and that government wanted such a negotiation in April 2023.

Ken Ofori-Atta, Ghana’s Finance Minister

“We are expecting them to call…they wanted such a meeting in April but unfortunately the technical team had left for Bolgatanga for the May Day celebration so that meeting didn’t come on, but we are expecting that government will come back with a new date” he stressed.

Background

Upon the government’s announcement of its intentions to implement a Domestic Debt Exchange Programme (DDEP), the group to first request exemption was Organised Labour.

They made it clear to the Finance Minister, Ken Ofori-Atta, that pension funds should remain untouched.

Following weeks of protests and the looming threat of strikes, the government ultimately caught Labour by surprise by granting them a “Christmas present” which meant the government would proceed with the DDEP while ensuring that pension funds would not be affected.

More than five months after this assurance, Labour has been asked to come back to the negotiation table for fresh talks on the matter as the government struggles to balance the economy of the debt-ridden West African country.

Mr. Koomson explained that the Finance Ministry agreed to exclude pensions from the program on the condition that labor groups could establish an alternative plan in collaboration with the central bank. He revealed that labor unions had already initiated discussions with the central bank.

Based on data from the Central Securities Depository Pension, pension funds held approximately 6% of Ghanaian domestic public debt, amounting to 181 billion cedis ($20.1 billion) as of September 2022.

In the upcoming debt treatment talks with labor, the Finance Ministry aims to reduce approximately 30 billion cedis ($2.7 billion) from pension funds.

In February 2023, the government successfully reduced about 83 billion cedis of its domestic debt through the program. The participation rate was 85%, excluding T-bills and bonds held by pension funds. The average maturity of the reduced debt was 8.2 years.

- Ghana's external debt treatment deal 'clears path' for board consideration of first review - IMF

- Ghana's IMF deal equal to 'making a deal with the devil' – Prof. Hanke

- Government reaches agreement with bilateral creditors on debt treatment

- GSE delivers 20th positive year with market capitalisation rise of GH¢73.89 billion

- ‘Eurobond holders are very unlikely to lend to African countries in future’ – Former AfDB chairman

- Read all related articles